Hard Guarantees #13: How Bitcoin Gets Unstuck

Your Bitcoin transaction got stuck because the fee was too low. Or worse, the payment you were waiting on is stuck. What now?

Hard Guarantees #13: How Bitcoin Gets Unstuck

Most people misunderstand this problem. Bitcoin didn’t design it away. It designed economic tools to deal with it.

Traditional Finance vs. Bitcoin

Your bank:

- Transaction problem? Customer service fixes it.

- The institution absorbs the error.

- Human intervention smooths things out.

Bitcoin:

- Transaction problem? Use market tools.

- Replace-by-Fee (RBF): rebid in the fee market to replace your transaction.

- Child-Pays-for-Parent (CPFP): create incentives for miners to confirm your transaction along with its dependencies.

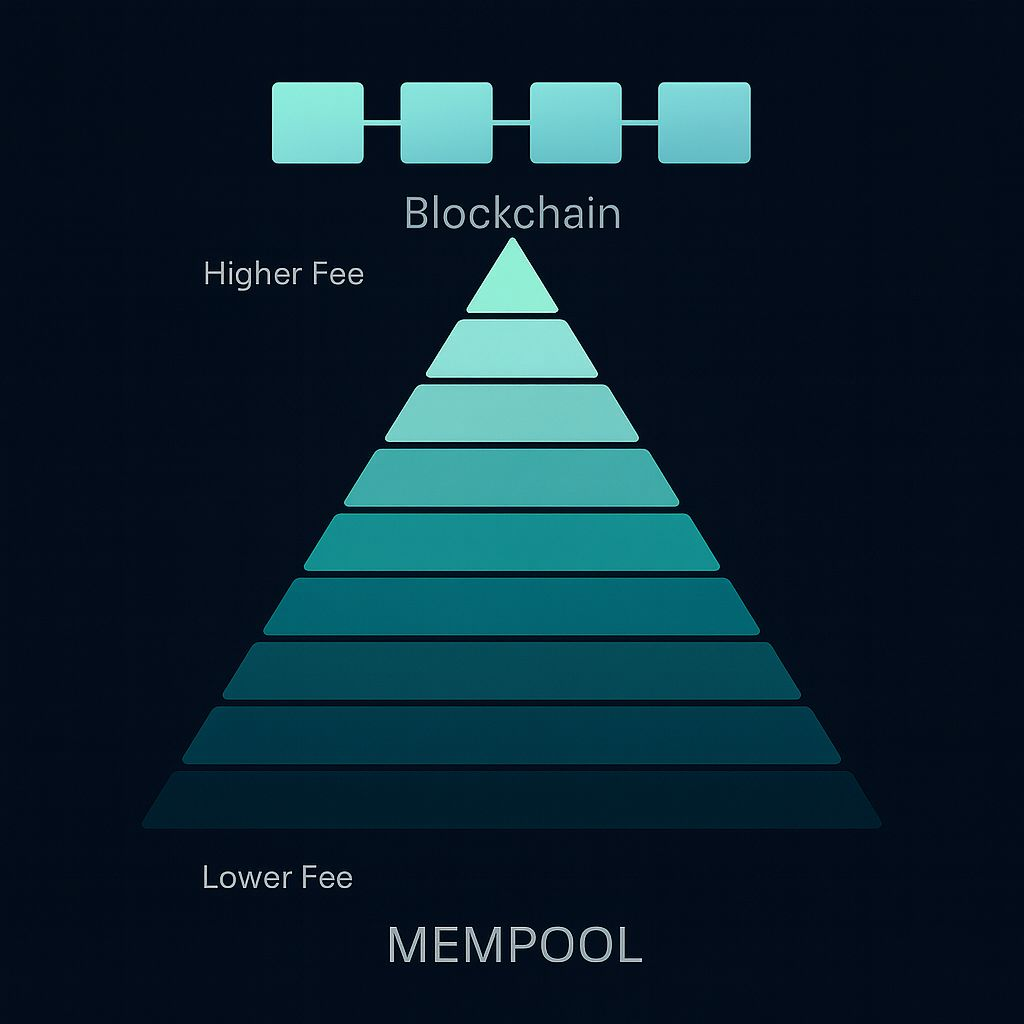

- Scarce block space is allocated by economic forces.

The Real Design Philosophy Bitcoin doesn’t promise every transaction will go through seamlessly. It promises that incentives will produce predictable patterns you can act on.

The trade-offs:

- No customer service.

- Market volatility shapes your experience.

- No reliance on institutions.

- The same rules apply everywhere to everyone.

The Mental Model Shift Success with Bitcoin requires different questions. It's not “Why is this so complicated?”. It's “What incentives are driving this outcome?”

It’s not about expecting institutional fixes. It’s about learning to navigate market-based problem solving.

The Bigger Picture Every Bitcoin “UX problem” is really about this choice: economic coordination over institutional promises.

- Fee estimation is hard because you’re predicting a market.

- Solutions cost money because you’re buying an outcome.

- This isn’t poor design. It’s intentional design for economic participation instead of customer service.

The real question is: do you want to rely on institutional guarantees, or do you want to understand economic coordination?

Bitcoin chose economics. Everything else follows from that choice.